Other Fees & Charges

Discover more about additional fees that may apply, such as the administrative fee associated with Islamic accounts and rollover charges.

Islamic accounts, which comply with Sharia law, may incur administrative fees to cover the cost of providing interest-free trading services.

Rollovers refer to the interest or swap rates applied to positions held overnight, which can vary based on the currency pair and market conditions.

For detailed information on specific fees and charges, please refer to the Littium Futures website or contact our customer support team.

Account Opening

Littium Futures does not charge any fees for account opening or maintenance.

Deposits

Littium Futures does not charge any handling fees for deposits. However, some methods including international wire transfer or e-wallet might incur charges. Please check with your bank or service provider for more information.

Withdrawals

Littium Futures will reimburse the bank charges for the first withdrawal by International Bank Transfer each month. Additional International Bank Transfer withdrawals within the month will incur a bank handling fee of 20 units of the account currency, with JPY & HKD using the equivalent of USD20.

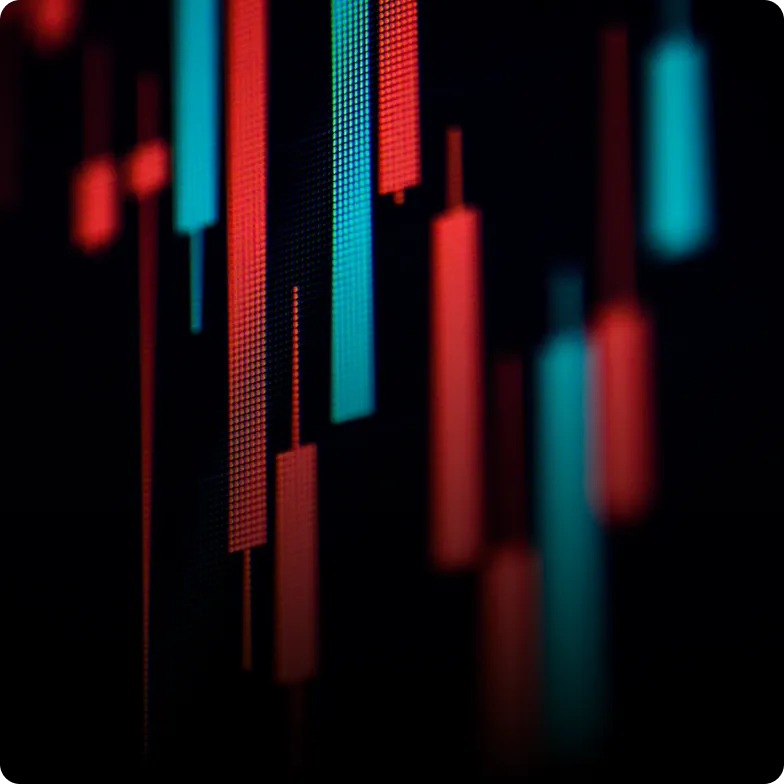

Rollover

Even though a rollover fee is charged on futures positions at the end of each month, the same amount charged will be credited back to your account balance to maintain a net neutral position. Rollovers can be monthly or quarterly.

Affected products include, but are not limited to: CL-OIL, VIX, USDX, HK50ft, DJ30ft, DAX40ft, NAS100ft, SP500ft,UKOUSDft,FTSE100ft, China50ft, FEI, FGBL, FGBM, FGBS, FBGX, FLG and TY.

Administration Fee

Islamic trading accounts incur an administration fee in lieu of any overnight interest so that the account is Halal. Administration fees are set by our liquidity providers and are variable.

Dividend Adjustments

If you are holding an overnight short position on certain dividend-paying shares or index CFDs into the ex-dividend date, you will be charged the dividend component.